Kindness, Experience

& Professionalism

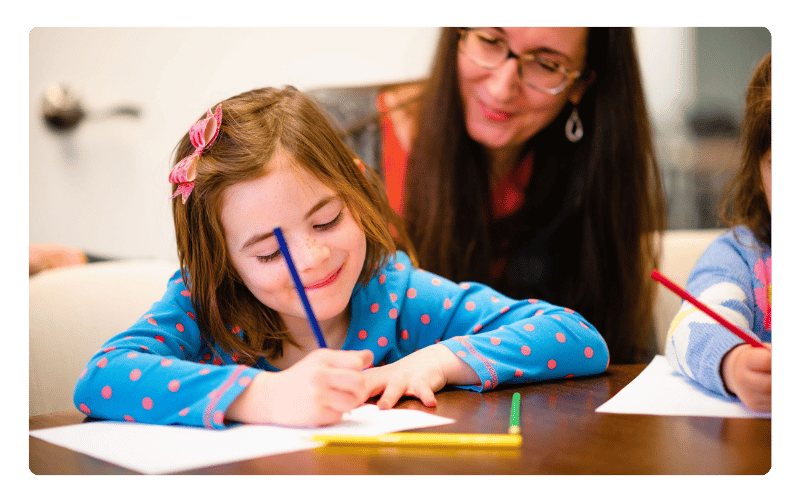

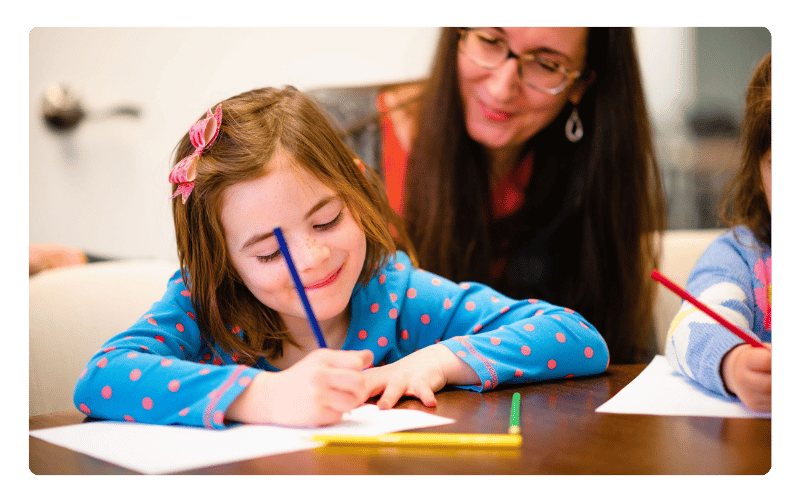

Experience the Vested Academics Difference

Learn why families trust Vested Academics for professional educational consulting, testing, and learning support—from kindergarten to college graduation.

Educational Planning

Thoughtful and strategic guidance for your student’s academic journey.

From private school placements to college admissions, we provide steady, personalized guidance rooted in experience and insight.

Private School Admissions

We help families like yours find the right private schools.

College Admissions

Guidance and support throughout the entire college planning process.

Academic Guidance

Expert guidance to help students access the support they need.

A Proven Approach

Testing & Evaluations

Comprehensive psychological and academic achievement evaluations, from start to finish.

Our experienced clinicians and specialists perform thorough testing and evaluations, offering professional guidance and interpretations that help parents understand results and next steps.

Psychological Evaluations

Our clinicians offer families a wide array of testing instruments.

Academic Evaluations

For a warm & understanding yet accurate & professional evaluation.

School Placement Evaluations

Individualized school placement evaluations, guided by care and insight.

Testing Designed for Education

Our experienced clinicians and specialists perform thorough testing and evaluations, offering professional guidance and interpretations that help parents understand results and next steps.

Subject Tutoring

& Academic Coaching

Customized learning plans, tailored to the unique needs of each student.

Subject Tutoring & Academic Coaching

Customized learning plans, tailored to the unique needs of each student.

From filling learning gaps to mastering new concepts, our team offers students of all ages and levels outstanding, one-on-one learning.

Client Success Stories

Stories of growth, confidence, and results—told by the families we’ve supported.

Stay InVested

Sign up for our e-Newsletter for expert advice from our educators and clinicians.