12 Important Ways to Save Money When Applying for Financial Aid (No Matter How Much You Make)

Love don’t cost a thing. But college does and saving money for your child’s education means receiving less if not done right.

Love don’t cost a thing. But college does and saving money for your child’s education means receiving less if not done right.

From putting assets in your child’s name to delaying that scholarship search, the financial aid application process shortchanges families for being unprepared. However, savvy applicants at every income level can save themselves from digging their own money pits by paying attention to these twelve tips.

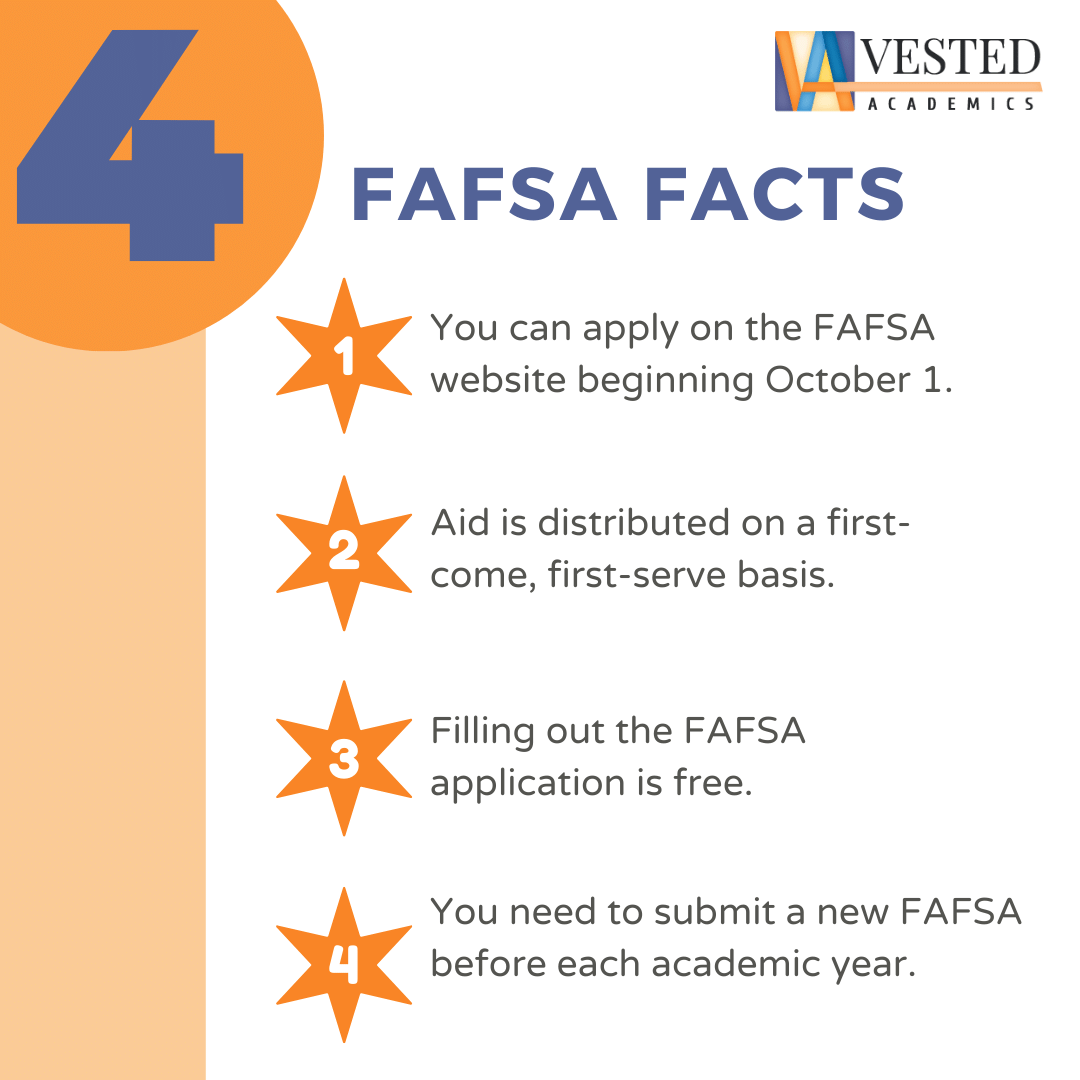

File the Free Application for Federal Student Aid (FAFSA), even if you’re not eligible for “free money.” Completing the FAFSA opens doors to professional opportunities through Federal Work-Study as well as the Parent PLUS Loan. Institutional scholarships may also require a FAFSA on file.

Deadlines wouldn’t matter if they didn’t have the word “dead” in them. Know what the priority deadlines are for your financial aid office. Completing the FAFSA on time makes or breaks a student’s chance at getting any need-based aid they qualify for. You can learn more about FAFSA deadlines on the Federal Student Aid website.

Some assets count more than others. Custodial bank accounts and trusts in a student’s name reduce their need-based aid on the FAFSA by 20 percent. Parent assets have a less than 6 percent effect.

Some assets aren’t counted at all. Primary home equity and balances in qualified retirement plans (401(k)s, pensions, and IRAs) aren’t considered by the FAFSA (but contributions and untaxed distributions are).

The FAFSA formula considers discretionary income at nearly 50 percent for students and parents. Selling stocks, bonds, or mutual funds for capital gains can eliminate need-based aid.

Families with 529 college savings plans have their contributions treated as gifts for tax purposes. Individuals can contribute up to $15,000 in 2019, or $75,000 spread out over a five-year period, and qualify for the gift tax exclusion.

Putting a 529 plan in a grandparent’s, uncle’s, or aunt’s name causes distributions to be treated as untaxed income on the student’s FAFSA. Either leave the plan in a parent’s hands or wait until the last FAFSA gets filed before you cash out.

Knowledge is power. Comparing your child’s award letters is critical. The downside is that you only have a short window of time to make a decision. Working with a professional financial aid consultant can help you weigh your options and select the best choice for your unique situation. You can learn more about our financial aid consulting services HERE.

See what a school’s financial aid office includes in their “cost of attendance” before passing on a more expensive option. The merit aid your child receives might bring a private school’s tuition and fees in line with their other choices.

Looking for a Financial Aid Consultant?

Colleges are competing for your child’s enrollment deposit. Start with admissions and ask how merit aid gets distributed. Would improving your child’s test scores or class rank result in more money?

There’s no guarantee your child’s financial aid award will remain the same year to year. See if a school front-loads freshman-year financial aid and learn the GPA requirements for their scholarships.

Include your child. It’s their future. Speaking openly and honestly about your family’s finances makes for informed decisions about advanced placement credits, taking prerequisites at community college, or whether to live on or off campus.

At Vested Academics, our financial consultants help clients make informed decisions about college costs. Contact Our Team to learn more.

Attend our classes and events on this topic. From webinars to in-person events, guest speakers to professional instruction, our events calendar is filled with outstanding resources for parents and students alike. Go to the Events Calendar.

Joseph Novinson is the Lead Financial Aid Consultant at Vested Academics. He regularly counsels students, parents, and families on all aspects of the financial aid process.

» LEARNING

Meet our new Lead Spanish Instructor, Jovann Silva Delgado!

» COLLEGE ESSAYS

Ugh! College essays and résumés are stressful. These free resources can be real lifesavers.

» Grade 9 & 10 Guidance

Once a Bourgie fad, this service now helps all students get more out of high school and gain more college choices later.Get access to Learning Support and College Coaching tips, helpful information, articles, and upcoming events.

T: (617) 245-4003

Info@VestedAcademics.com

Email Our Team

Book Free Consult

200 Cordwainer Drive

Suite 201A

Norwell, MA 02061

USA

Mon-Fri: 9:30 a.m. – 6:30 p.m.

Sat: 10:00 a.m. – 5:30 p.m.

Kindergarten

Grades 1-5

Grades 6-8

Grades 9-12

College Students

Our Company

Our Learning Center

Meet Our Team

Blog

Job Opportunities

Here’s Why Your 9th or 10th Grader Needs College...

Here’s Why Your 9th or 10th Grader Needs College...